Understanding Retirement and Disability Benefits

Executive Summary

The financial support available to former members of the Canadian Armed Forces (CAF) is comprehensive, offering those who serve our country a competitive compensation and benefits package that rivals and often exceeds those offered in the private sector. As standalone pension plans, the Canadian Forces Superannuation Act (CFSA) pension plan and the Canada Pension Plan Retirement Pension (CPP), both contributory plans, provide former members with income that contributes to their financial wellbeing during their retirement years. For the large majority of former members of the Canadian Armed Forces, the current system works very well and the pension plans’ interrelationship with the Canadian tax system and related offset provisions are well-documented. However, the development, implementation, and roll-out of these plans could result in unintended consequences, real or perceived, for certain groups of recipients.

“Offset” Explained:

To reduce an amount of income with an equivalent amount of income from a similar source.1

Issues related to the interrelationship between the CFSA and CPP are not new. In 2005, members of the group titled “CAF and RCMP Veterans Against the CPP Annuity Benefit Reduction at Age 65” began to raise issues pertaining to the pension plans themselves, as well as how they are viewed independently and jointly in the eyes of Canadian tax law. In total, the group has raised six distinct issues of perceived unfairness related to the pension plans. The issues can be read in their entirety, in the words of the complainants in Annex A. Although these issues have been raised with multiple government departments, in Parliamentary debate, and even resulted in proposed legislation from individual members of Parliament, resolution and/or adequate responses to these issues remain outstanding.

This review seeks to address these six issues by examining the financial support currently available to former members of the Canadian Armed Forces through the CFSA, the CPP, and other benefits and seeks to clarify and/or address the issues raised by this stakeholder group. It is important to note that as a result of our research, evidence was uncovered that could also directly affect members of the Royal Canadian Mounted Police, as well as Federal public servants.

It is also important to note that while this office examined a range of benefits, given specific plans referenced by the group, we focused solely on those pertaining to economic loss.

During our office’s review of the issues raised, it became apparent that one issue, divided into two groups of individuals (Group A and Group B) could result in unfairness to the parties affected, and are subsequently addressed in the body of this report. The remaining five issues required clarification rather than action, and are consequently addressed in Annex B. It is our office’s sincere hope that this report is used to inform dialogue between the government and the veterans group moving forward.

1- Offset from Manulife payments: https://www.manulife.ca/wps/wcm/connect/b9d04856-4a8d-48d9-b2ff-7f937b365fa0/LTD+Benefits+Guide+GC2179+E+Full+Page+Format.pdf?MOD=AJPERES&CACHEID=b9d04856-4a8d-48d9-b2ff-7f937b365fa0

Introduction

The purpose of any pension plan is to offer financial security to their contributory base according to the circumstances in which those benefits will be paid as outlined in the policy agreed to by the payee and the payer. For members of the Canadian Armed Forces:

“the mission of the Canadian [Armed] Forces (CF) pension plans, referred to as the Canadian Forces pension plan (CFPP) and the Reserve Force pension plan (RFPP), or collectively as the “pension plans”, is to develop and deliver retirement and survivor benefits that recognize the contributions to Canada made by current and former Regular Force and Reserve Force members and their survivors. The pension plans are an important part of helping Canadian [Armed] Forces members achieve financial security in retirement, and a key component of the overall compensation package. The mission also intends to ensure that administrative expenses of the pension plans are comparable to those of similar pension plans and that they are managed efficiently and effectively. The assets of the pension plans are protected through compliance with applicable federal legislation and judicious investments chosen to ensure long-term sustainability.”2

Canadian Armed Forces members, Regular Force and Reserve, not only contribute to their respective pension plans, but also contribute to the Canada Pension Plan retirement pension (CPP), a mandatory plan which is available to all Canadians who are employed.

The Canada Pension Plan was enacted on January 1, 1966 and over the years, its provisions and interrelationship between other public and private pension plans when its benefits are considered by the Canada Revenue Agency has been the source of confusion, angst, and in some cases, perceived unfairness in its interpretations.

The issue of the coordination between both contributory pension plans had been raised in 2005. After years of engaging the Department of National Defence, other federal government departments, and members of both chambers of the Parliament of Canada, a group known as the “CAF and RCMP Veterans Against the CPP Annuity Benefit Reduction at Age 65”, engaged the Office of the National Defence and Canadian Armed Forces Ombudsman to seek resolution to these complaints.

Who Is Affected?

Issue 1 A) specifically pertains to those former members, in receipt of their CFSA pension, who have been medically released3 from the Canadian Armed Forces and are in receipt of benefits such as the Service Income Security Insurance Plan Long-Term Disability Insurance (SISIP-LTD) and/or the Veterans Affairs Canada Earnings Loss Benefit; AND who are in receipt of an approved Canada Pension Plan Disability benefit as a result of an illness or injury sustained in civilian life.

Issue 1 B) pertains to those former members of the Canadian Armed Forces who are drawing their military pension (CFSA) and have not been medically released from the CAF. Additionally, they are in receipt of a Canada Pension Plan Disability benefit as a result of an illness or injury sustained in civilian life.

This table can serve as an easy reference guide to determine affected individuals for issues 1A and 1B:

| Issue 1A | Issue 1B | |

|---|---|---|

| Former CAF Member | Yes | Yes |

| Medically Released | Yes | No |

| In Receipt of CPPD | Yes | Yes |

|

In Receipt of SISIP-LTD and/or VAC ELB, and/or CFIS |

Yes | No |

| In Receipt of CFSA* | Yes | Yes |

*This may not necessarily apply should the former member have received a return of contributions or had less than two years of service in the CAF before release.

It is the intent of this discussion paper to address this issue of potential unfairness separate and apart from those distinct yet relevant recommendations made by the veterans group that may require legislative action on behalf of the government.

As previously mentioned, the remaining five issues required clarification rather than action, and are consequently addressed in Annex B.

2 - Excerpt from a CFSA Annual Report https://afpaac.ca/PDFs/News/CFSA%20Annual%20Report%202011-12.pdf

3 - Members who are not medically released but who subsequently identify injuries or illness as a result of their service may also be affected.

Scope And Methodology

Scope

To review, analyze, and consolidate information from all relevant sources relating to pension and disability benefits and their tax implications for former members of the Canadian Armed Forces.

During this exercise, we examined the benefits listed below,4 but only focused on those dealing with economic loss (not pain and suffering):

|

Department of |

Government of |

Veterans Affairs |

|---|---|---|

|

Canadian Forces Superannuation Act (CFSA) Service Income Service Insurance Plan (SISIP) Vocational Rehabilitation Program (VRP) |

Old Age Security Canadian Pension Plan Canada Pension Disability Benefit The Disability Tax Credit Government Employees Compensation Act (Reserve Force only) |

Canadian Forces Income Support Disability Benefits Disability Awards Exceptional Incapacity Allowance Health Care Benefits (Treatment Benefits) Career Impact allowance Supplementary Retirement Benefit Veterans Independence Program Critical Injury Benefit Earnings Loss Benefit Retirement Income Security Benefit War Veterans Allowance The Caregiver Recognition Benefit The Education and Training Benefit New Pension for Life (April 1, 2019) |

Methodology

The approach to this project involved pursuing multiple lines of enquiry, including a review of the legislation, regulations, policies, databases, and other information sources. Also, a meeting was held with the “CAF and RCMP Veterans against the CPP Annuity Benefit Reduction at Age 65” group and interviews with various stakeholders for the purposes of qualitative information gathering and the provision of context.

The information collected through these lines of enquiry was used to perform the analysis, synthesis and findings contained within the report.

4 - More information on these benefits can be found at:

Department of National Defence: www.forces.gc.ca

Veterans Affairs Canada: www.veterans.gc.ca

Government of Canada: www.canada.ca

Discussion

Issue 1

A) Are those who have been medically released from the Canadian Armed Forces subject to a reduction in benefits such as the Service Income Security Insurance Plan Long-term Disability Insurance and/or the Veterans Affairs Canada Earnings Loss Benefit and/or the Canadian Forces Income Support Benefit equivalent to the CPP Disability Benefit that has been approved?

B) Are those who have not been medically released CAF members in receipt of the Canadian Forces Superannuation Act pension and who are awarded a CPP Disability Benefit as a result of an illness or injury sustained at a later point in life subject to a substitution of the pension “bridge benefit”?

What is a Bridge Benefit?

A Bridge Benefit is a temporary benefit intended to supplement your retirement income until you start receiving C/QPP benefits, which is normally at age 65. The bridge benefit is important because many CAF members retire well before the age of 65 and therefore this is an essential component of one’s financial security until those C/QPP benefits are made available.5

Our Assessment

It is a generally accepted industry norm that long-term disability (LTD) insurance policies such as Service Income Security Insurance Plan (SISIP) reduce benefits, dollar-for-dollar, based on what the recipient receives as a CPP Disability Benefit. For example, a former member in receipt of a SISIP payment of $1,000 per month who subsequently qualifies for a CPP Disability Benefit of $400 per month, has the SISIP benefit reduced to $600 per month.

Even though there is no immediate financial gain for a former member to apply for a CPP Disability Benefit, the approval of the CPP Disability Benefit could avoid a potentially lower CPP Retirement Pension in later years because they are not penalized for not contributing to CPP. Any period of time that they are in receipt of the CPP Disability Benefit is excluded from the calculation of the number of contributory months, a key component in calculating the CPP Retirement Pension. Otherwise, they will be assessed as having made zero contributions during this period of time, thus reducing their average annual contributions, and this can result in a lower CPP Retirement Pension.

Canadians’ contributory period begins at the age 18 or in January 1966, whichever is later. It ends either at age 70 or on receipt of CPP whichever is earlier. The number of contributory months is the total number of months in a contributor’s contributory period, minus any months excluded, such as a result of receiving a CPP Disability Benefit.6

Interested in Issues 2-6? Visit Annex B

There could be a negative financial impact to the former member, once a CPP Disability Benefit is approved, as the “bridge benefit” is terminated retroactive to the date of any retroactive CPP Benefit. It is important to note that the “bridge benefit” is not reduced dollar- for -dollar as is the case with long term disability plans such as SISIP. Rather, it is reduced in its entirety without any regard to the amount of the CPP Disability Benefit.

It is the position of our office that when lawmakers and government officials deliberate this issue, particular consideration should be given to the fact that members of the Canadian Armed Forces are subject to a mandatory retirement age of 60. The absence of choice in retirement age and the fact that receipt of a full Canada Pension Plan Retirement benefit is only available after age 65 creates a unique circumstance for these individuals. This is a known gap that, absent of second career employment between the age of 60 and 65, can result in lower or no CPP contributions during that time, directly impacting retirement income for this group of former members.

5 - If you retire before age 65, you will also receive a bridge benefit. This temporary benefit helps “bridge” your pension until age 65, when CPP/QPP is expected to begin. https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/retirement-income-sources.html#formu2

6 - Complete details of CPP Retirement Pension eligibility. https://www.canada.ca/en/services/benefits/publicpensions/cpp/contributions.html

Moving Forward, Together

Our office would like to thank the “CAF and RCMP Veterans Against the CPP Annuity Benefit Reduction at Age 65” group for raising these issues. Given that the concerns raised from these former members of the Canadian Armed Forces and the Royal Canadian Mounted Police began in 2005, it is unsettling that they have not been addressed wholly by government. Our analysis of the remaining five issues can be found in Annex B of this report.

While our office has concluded that one of the six issues could create unfairness under the current coordination pension plan, the remaining five issues raised - while not unfair in their current application - would require consideration by lawmakers as to the merits and related costs of making changes to legislation, regulations, or policies to meet the objectives of the “CAF and RCMP Veterans Against the CPP Annuity Benefit Reduction at Age 65” group.

As mentioned above, Issue 1 A) and 1 B), are of concern to this office. While the consequences of the development and implementation of these benefits may have been unintended, they exist nevertheless. The primary concern is that former members of the Canadian Armed Forces and Royal Canadian Mounted Police discover this issue after they release from their respective organizations. The three primary consequences are:

- There is a gap of contributions between the mandatory retirement age of 60 and the age of 65 when individuals can draw their CPP Pension Plan without penalty.

- There is a total loss of the bridge benefit upon commencement of receipt of CPP Disability Benefit.

- As a result of 1 A) and 1 B), if an individual is disabled, released from the military, and applies for CPP Disability Benefit, they are deemed to be “contributory” to the plan. Should they not immediately apply for CPP Disability Benefit, they are deemed “non-contributory”, and could lose valuable years that count towards retirement benefits.

The prospect of financial loss for many former members could mean the difference between a comfortable and uncomfortable retirement.

While the number of those affected by Issues 1 A) and 1 B) is unknown at this time, it is likely not many. This policy gap merits closer consideration by lawmakers moving forward.

Finally, it is important to note that our office recognizes and by no means dismisses any of the arguments made by the “CAF and RCMP Veterans Against the CPP Annuity Benefit Reduction at Age 65” group as they relate to the sacrifice that they or their families have made both socially and financially as a result of their service to country. In fact, the legislative history of this country reveals many social programs that were built on that very premise. However, it is not the role of the Ombudsman’s office to advocate for the creation of new benefits and services to reflect that sacrifice. That responsibility falls squarely on the legislative and executive branches of government.

Our office stands ready to assist the government in its considerations by providing and elaborating on the evidence it has collected to the relevant organizations, and work on potential solutions alongside decision-makers should we be engaged to do so. We are ready to help.

Annex A – Letters I

From: John Labelle [mailto:florencejohn@ns.sympatico.ca]

Sent: July-19-15 7:37 PM

To: John Labelle

Subject: Veterans issues!

1.

Military/RCMP Veterans

Against CPP/QPP Annuity

Benefit Reduction at age 65

Or sooner if Disable

“ For immediate distribution, including Face Book and Twitter “

Dear Sisters and Brothers,

For us the problem is the constant bickering of Veterans. Far too many will not stand up and lead Veterans issues but when someone else does, they find ways to disagree and/or complain.

Mr. T. Mulcair’s, NDP Leader, Military/RCMP Veterans priority list:

10 years later, our committee has received 2 signed documents from Mr. T. Mulcair, NDP Leader. He has identified what issues he will resolve if elected Leader in the next election campaign.

In the first session of Parliament he will terminate the CPP/QPP pension claw back issue.

In the second signed letter he has identified many other issues that the NDP will fix for Military/RCMP Veterans and their Families.

Remember that no other Leader signed our requested Resolution!

Please read the following commitments:

Mr. Mulcair, NDP leader signed another letter identifying Veterans issues he will resolve:

Ensuring economic security for Canadian Forces Veterans and families, including all spouses, by extending the Veterans Independence Program and enhancing survivors pension;

Ending the unjust offset of Veterans Affairs Canada (VAC) disability pensions for medically released members of the RCMP;

Supporting initiatives to help Veterans transition into civilian workforce, such as a “Helmets to-Hardhats” program to help Veterans transition to construction and shipbuilding trades;

Responding to Veteran’s organizations, spouses, windows and widowers, and initiating a Public inquiry into toxic chemical defoliation at CFB Gagetown;

Expanding the Veterans Independence Program for all Veterans, Widows and Widowers, including the RCMP;

Supporting modern day Veterans access to long-term care veterans facilities, and initiating discussions for new health care Centers of excellence that specialize in Veterans care;

Ensuring that all Veterans and their estates have access to a dignified funeral and burial by expanding federal government allowances;

Removing the restrictive marriage clause after 60 so surviving spouses of Veterans can access pension and health benefits;

Increase the survivor’s pension amount from 50% to 66% so surviving spouses of Veterans can manage basic living expenses with dignity;

Replacing the politically appointed Veterans Review and Appeal Board with medical evidence-based peer reviewed process for making decisions on Veterans disability applications, in consultation with Veterans and Veterans organizations.

Furthermore check out listed information found on the NDP web site:

Restore home mail delivery;

Federal minimum wages increase to $15.00 hour;

Ensure childcare for no more than $15.00 a day;

Negotiate closure of the Senate;

Stop Harper’s tax giveaway to the wealthy

Its up to us all!

We can bicker or we can choose to stand together!

“Honour, Dignity, Justice, Equality!”

Send us your e-mail address, if you wish to stay current with our Pension claw back issues.

John Labelle

Veterans Annuity Campaign

Coordinator

Stand up for the Dignity of Veterans!

Annex A – Letters II

From: John Labelle florencejohn@ns.sympatico.ca

Sent: August-27-17 3:20 PM

To: pierre.poilievre@parl.gc.ca

Cc: macneilreina@gmail.com; jpdmartinello63@gmail.com; John.Brassard@parl.gc.ca;

+Ombudsman-Communications@Ombudsman@Ottawa-Hull

Subject: Your Correspondence - Veterans CPP Benefits

Attachments: Campaign Paper April, 2016.wpd; Campaign facts Apr 2017.wpd

Military/RCMP Veterans

Against CPP Annuity

Benefit Reduction at age 65

Or sooner if Disable

To: Hon. Pierre Poilievre, MP

Carleton, Ontario

Info: Mrs. Reina Mac Neil

Translator/Member

Mr. J.P. Martinello

Member

Mr. John Brassard, MP

Conservative Veterans Affairs critic

Mr. Gary Walbourne

DND Ombudsman

Military/RCMP Veterans

Honour, Dignity, Justice, Equality!

August 28, 2017

Re: Veterans CPP Benefits

References:

A. Your e-mail dated August 23, 2017, enclosed.

B: Our attached Campaign paper info

Mr. Poilievre, MP

Let us advise you that Military/RCMP Veterans across Canada are very disturbed with your lack of support towards our Veterans issue and your listed misleading/unfounded statements. Other Conservative MP’s have made similar statements regarding Veterans CPP contributions and their benefits. The former Hon. Peter MacKay, MP identified that it would cost $7.2 billion dollars to administer the CF Annuity plan, when the CF Annuity cost for the year ended 31 March 2008 was only $2.2 billion. MP Laurie Hawn estimated the cost at $7.4 billion dollars. Hon. Erin O’Toole 2017 indicated that it would cost 7 billion dollars. Hon. Andrew Leslie, 2017 indicated that it would cost $7 billion dollars, just to name a few....

Your reference e-mail Para 2.

For your information, in 1966 with the introduction of the CPP plan our CFSA contributions were 6.5% and 1% for indexing. The CPP contributions were 1.8% of our basic rate of pay. Today’s CFSA contributions are the same 7.5% but the CPP contributions have been elevated to 4.95% of our basic rate of pay, an increase of 3.15%. These contributions continue to be listed separately on our pay guide. The Government of Canada enacted the Canada Pension Plan (CPP) in 1965 and the plan came into force on January 1, 1966. Its intention was to provide another source for an “ Income Security “ program to supplement the Old Age Security Pension Plan. It is ridiculous to assume that we should over contribute to two (2) plans if we only receive the equivalent of one benefit. The CFSA plan has a surplus of over 62 billion dollars and the CPP plan is forecasted to reach 15 trillion dollars by 2090.

Bridge Benefits:

The phrase “ Bridge Benefits “ is a misrepresentation of facts ! It is not listed in the pension Act and/or the Base Financial Counsellor’s Manual. ( A-Fn-109-001/ID-001) Furthermore, the manual was not made available to service personnel. The Bridge Benefits term is a myth that was never used prior to the establishment of our Annuity Campaign.

Bill C-201:

The fact is that the Government of Canada has broken our enrolment contract without prior members consultation or authorization. During our enrolment procedures we were promised that we would benefit of a full pension calculated at 2% of our best 6 years for a period of 25 years of service. The Speaker of the House of Commons terminated the forward movement of Bill C-201 because Former Prime Minister Harper did not honour his 2005 election campaign promise to respect the successful vote of Parliament Bills. The Government must acknowledge the democratic successful vote of 149 yeas for Bill C-201. A royal Recommendation is not required. Bill C-201 was requested at no extra funds from the tax payers.

Quote: As the former Commissioners with the Canadian Pension and Appeal Board, I know that such initiative could be remedied by the Commissioner’s Executive with a simple White Paper, followed by a request to the Minister of Veterans Affairs Canada (VAC) for the needed action and amendment to the Pension Act and its policies.

Conclusion:

Military/RCMP Personnel are a different Government provider. Unlike other segment of the population they often work in deplorable conditions without over time pay. What price tag can be placed on the voluntary services we ask our Spouses to perform while we serve our Country Canada. Consider the loss of our Spouses employment income opportunities as the result of many operational moves. Many posting led to the loss of their Spousal CPP benefits. They often faced extended Family separation with elevated level of stress while maintaining a Family on their own. The unavailability to celebrate Anniversary,

Birthdays, Family gathering, just to name a few....

You are well aware that Bill C-201 should have been allowed to continue its forward movement. Surplus Canadian Forces Pension Funds are considered to be a SACRED TRUST OBLIGATION to the welfare of Forces personnel and their Families during their retirement Golden Years.

The question is:

As a member of Parliament are you prepared to stand up for Military/RCMPVeterans and their Families? Will you stand up for Veterans living in your ridding of Carleton, Ontario and all Veterans across Canada? Many are now in their eighties....They have fully paid for all their benefits. They seek no retro active payments. They seek no extra funds from the tax payers.

On this November 11, allow us to remember our fallen Comrades and demonstrate to our living Veterans and their Families your appreciation for their sacrifices while serving our Country Canada.

“ Kindness is a language the Deaf can hear & the Blind can see ! “

Sincerely,

John Labelle

Veterans Annuity Campaign

Coordinator

Annex A – Letters III

From: pierre.poilievre@parl.gc.ca

To: florencejohn@ns.sympatico.ca

Sent: Wednesday, August 23, 2017 10:26 AM

Subject: RE: Your Correspondence - Veterans CPP Benefits

Dear John,

Thank you for your contacting me regarding CPP clawbacks for military and RCMP personnel.

I am familiar with this issue and other Canadian Armed Forces (CAF) retirees have raised. The heart of the issue is the bridge benefit amount of the pension received when a CAF member retires before the age of 65.

CAF members were paying 6% of their salaries to their pension plan; when CPP was integrated with the Canadian Forces Superannuation Act (CFSA) the 6% continued to be paid. The 6% was split 4.2% going to the CFSA and 1.8% to CPP. The bridge benefit paid when the CAF member retires until CPP payments kick at the age of 65 was 2%.

The 2% bridge benefit in most cases is equal to the amount of the CPP payments. The deciding factor in this matter is whether or not the CAF member earned any taxable income between CAF retirement and CPP eligibility. If there was no new taxable income, the CPP payment will be less than the bridged benefit.

Any reductions after the CPP payments begin is being treated similarly as non-military pensions with bridging provisions act in the same manner and also see reductions after the CPP payments begin after reaching the age of 65.

Finally, I would point out that Bill C-201, from the 3rd session of the 40th Parliament, was passed through Parliament until third reading in the House of Commons. Private Members’ Bills are not ordinarily allowed to spend taxpayers’ money, and when they propose to do so, they require a Royal Recommendation. Bill C-201 did not receive a Royal Recommendation, and that is why it did not become law.Thanks again for contacting me.

Please do not hesitate to contact me again in the future.

Sincerely,

Pierre Poilievre,

P.C., M.P. Carleton

Annex A – Letters IV

Dear Military/RCMP Veterans,

The enclosed information is a short presentation identifying the lack of support our Veteran Committee has received from our elected Politicians serving Canada.

To our Disable veterans: We continue to support your issues but our Politicians are still in their Review, Review, Delay mode.

To our Committee members: Thank you for the support you have freely provided at no cost to any one, towards our Veterans issues.

Military/RCMP Veterans

Against CPP Annuity

Benefit Reduction at age 65

Or sooner if Disable

Review of CPP Pension claw back issue:

For a number of years Veterans have attempted to convince members of Parliament to take action, in the House of Commons, to terminate the unconstitutional CPP claw back to their earned Annuity at age 65 or sooner if Disable. The Government has in fact broken our enrolment engagement contract without consultation or authorization. This situation is now affecting the welfare of Military/ RCMP Veterans and their Families.

Until 2015, Why were Senators, Judge Advocates and Members of Parliament exempted the CPP claw back and Military/RCMP Veterans are not? Did they forget about the Sacred Trust obligation to Veterans?

Veterans find misleading statements of facts made by former military Officers and other Members of Parliament to be appalling. Veterans seek no additional funds from the tax payers.

How can politicians who may work in Ottawa 138 days this year, possess a minimum office staff of 4, find themselves too busy to answer Veterans of Canada’s concerns?

Pension Plans:

If you take a close look at all pension plans you will notice that they all favour over contributions by the members. The Canadian Forces Superannuation plan reached over 80 billion dollars surplus before the Government depleted almost 20 billion dollars to pay down the National debt. The Canada Pension Plan (CPP) over contributions will reach one (1) Trillion dollars surplus by year 2050. How many billion of dollars have been depleted from the unemployment insurance plan?

Election Calls:

Often we are bombarded by new election calls or requests for more donations to assist with their election campaign. These same Politicians that now request funds but can’t find time to support our pension issue. Have they forgotten that for every dollar we get that 60% of it is given back to the Government in one form of tax or another. Members of Parliament have forgotten who votes for them....

Military/RCMP Veterans

Campaign Paper history:

On February 21, 2005, encouraged by a number of Veterans and the support of Mr. Peter Stoffer, former MP of Sackville-Eastern Shore our committee has attempted to convince the Federal Government to amend the CFSA Act and the RCMPSA Act of a miscalculation in justice that affects the financial welfare of Veterans during their Golden Years.Campaign Facts:In the 2005 Federal election campaign , Mr. Harper, MP stated: “ When a motion passes the democratic elected majority of the House of Commons, The Government shall Honour that motion! ” On May 5, 2010, for the fourth time, Conservatives MP`s were directed to vote against our Bills. However, Bill C-201 count was successful and the final vote recorded was 149 yeas and 134 nays. The speaker of the House of Commons declared that Bill C-201 was carried, but he then discharged it from the agenda because Prime Minister Harper refused to request a Royal recommendation and Bill C-201 died on the order table.

The Crux of the issue:

The Government of Canada has broken our enrolment engagement contract without member consultation or authorization. During our enrolment briefing we were promised that we would benefit of a full pension calculated at 2% of our best 6 years for a period of 25 years of service. Today the maximum contributions to both plans continue to be listed separately on our pay guide, given them a false sense of Financial Security. Furthermore, the vast majority of serving personnel were not informed of the CPP claw back until they arrived at age 65.

Over contributions:

In 1966 the CPP contributions were 1.8% of basic rate of pay. Today`s members contributions are 4.95% of their basic rate of pay. This over contributions policy will created a CPP surplus that will reach 1 Trillion dollars by year 2050. Take note that our contributions to both plans continue to be listed separately on our pay guide.

In 1965 the Canadian Forces member’s pension contributions was 8.3% and 1% towards our indexing revenues of our basic rate of pay. This excess pension contributions resulted in over 80 billion dollars surplus account.

Veterans are aware that the Government of Canada has depleted their CF Superannuation account by almost 20 billion dollars, 10 billion dollars was used to pay down the National debt.

Take notice that during the 6 and 5 price and wage control years, the Government of Canada took a contributions holiday to our service pension account and never paid it back....

Yet, as of 31 March 2013, the net assets held on behalf of the Canadian Forces Pension plan indicated that the Veterans Annuity plan totaled more than 62 billion dollars. It clearly indicate that Veterans have over contributed and are not receiving what they have paid for.

Politicians misleading of facts:

The phrase “ Bridge Benefits “ is a misrepresentation of facts! It is not listed in the Pension Act and/or the Base Financial Counsellor`s manual (A-FN-109-001/ID-001) The bridge benefit term is a myth that was never used prior to the establishment of our Campaign.

Veterans are receiving the Benefits for witch they have paid for.... Misleading statements without foundation.

Over the years a number of Conservative MP’s have mislead Veterans with regards to the amount of funds required to solve the CPP claw back issue. They stated that 7, 7.2, 7.4 billions dollars would be required to resolve our issue, when it only cost 2.3 billion dollars to pay all pensioners, including widows and children.

This worthwhile initiative continue to grow! Over 112,500 Military, RCMP/Veterans have pronounced their support of the issue. To date 121 former Colonel and Generals have signed our Veterans petition. It included the signature of 54 former officers of the rank of Generals and or former RCMP Superintendents.

The Dominion Command of the Royal Canadian Legion, the Army, Navy and Air Forces Veterans (ANAVETS) of Canada and the AIR Forces Association in Canada have adopted resolution at their Annual General meetings in 2006 in full support of our campaign. Support has also been received from Mrs. Lilian Morgenthau, founder and President of CARP (Canada’s Association for the 50 plus.) RCMP Deputy Commissioner Larry R. Proke, Mr. Bill Gildley, Executive Director, RCMP Veterans and Mr. Alex Geddes National Secretary, RCMP/Veterans Association have unanimously supported our issue. Numerous other Military Association have also declared their support.

On May 6, 2008 Mr. Jack Frost, Dominion Command President of the Royal Canadian Legion, sent a letter to the Minister of National Defence with copies to the Prime minister of Canada and the Minister of Veterans Affairs expressing his grave concerns regarding the issue of fairness pertaining to the CPP reduction to the CFSA.

In 2011, the Yukon and the Nova Scotia Provincial standing committees on Veterans Affairs unanimously passed motions in support of the Military/RCMP Veterans Annuity issue.

Conclusion:

Over the years elected Politicians that were suppose to stand up and support the Veterans in their constituency forgot about them once elected. Unfortunately we have witnessed puppet Politicians who were directed to support the dictatorship of their Party Leader. When will we be able to elect Members of Parliament that will be able to stand up and assist our Veterans and their Families? Military/RCMP Veterans and their Families have given their all towards the Protection and Security of Canada. Their Spouses have faced the loss of their income/employment opportunities as a result of numerous operational moves, leading to the loss of their Spousal CPP benefits. Our Spouse often faced extended family separations with elevated level of stress while maintaining a family on their own. The Military Spouse was often unavailable to celebrate Anniversaries, Birthdays and many other Family gatherings. Veterans often faced dangerous 24/7, 16 hour days without overtime compensation. Veterans often faced dangerous conditions, health hazards and they were committed to an unlimited liability. Where are the Leaders that will remember the sacrifices that all Military/RCMP Veterans and their Families have provided to the security of Canada? Where are the Leaders that will remember our Veterans and their families not just during the Remembrance Photo Ops week, but trough out the year?

Why must Veterans look for Law Firms to fight the same Government they were prepared to provide the ultimate sacrifice for.....

“ Honour, Dignity, Justice, Equality! “

Sincerely,

John Labelle

Veterans Annuity Campaign

Coordinator

florencejohn@ns.sympatico.ca

“ Kindness is a language the Deaf can hear & the Blind can see! “

902-864-2456

27 Dresden Court

Lower Sackville

Nova Scotia

B4C 3X1

Note: Send us your e-mail address to stay current with the issue. We maintain an e-mail address bloc list by Provinces and use the BCC format. We do not charge membership fees.

Annex A – Letters V

Military/RCMP Veterans

Against CPP Annuity

Benefit Reduction at age 65

Or sooner if Disable

Mission:

The Military/RCMP Veterans mission is to have the Government of Canada terminate the unconstitutional CPP Benefit Reduction to their Annuity at age 65 or sooner if Disable at no cost to the taxpayers. The Prime Minister must right a wrong and amend the CFSA and the RCMPSA ACT of a miscalculation of justice that affects the financial security of Veterans and their Families during their Golden Years.

Campaign Paper History:

Encouraged by a number of Veterans, on February 21, 2005 a letter was sent to Mr. Peter Stoffer, MP Sackville-Eastern Shore seeking his support towards a Private Member’s Bill aimed at resolving the Military/RCMP Veteran’s CPP Annuity benefit reduction issue. Following a meeting with him, we received a letter of support on April 28, 2005. Subsequently, a committee was formed with John Labelle as the campaign coordinator. Roger Boutin, Reina MacNeil and many other Veterans continue to assist with the campaign today.

Since 2005, Mr. Peter Stoffer, MP has introduced to the House of Commons Bill C-441, C-221, C-502, C-201 and C-215.A number of bills had to be introduced because of the short life of minority Governments. On November 2, 2006 he introduced to the House the Veterans first 5 points motion. On January 30, 2014 he also introduced to the House Bill C-572. “An Act to amend the Canadian Forces Superannuation Act and the Royal Canadian Mounted Police Superannuation Act!” (Deduction of disability pensions) Mr. Bill Casey, a former Conservative MP introduced Motion M -362 in support of Veteran’s annuity issue.

Prior to being elected Prime Minister of Canada, in the 2005 Federal election campaign Mr. Harper, MP stated: “When a motion passes the democratic elected majority of the House of Commons, The Government shall Honor that motion!” (Hansard 2005) Once elected he quickly changed his mind!

Unfortunately for Military/RCMP Veterans, on May 5, 2010, for the fourth time, Conservatives MP’s were directed to vote against our Bills. However, Bill C-201 count was successful and the final vote recorded was 149 yeas and 134 nays. The speaker of the House of Commons declared that Bill C-201 was carried, but he then discharged it from the agenda because Prime Minister Harper refused to request a Royal recommendation and Bill C-201 died on the order table.

The Crux of the issue:

Military/RCMP Veterans maintain that in 1965/66, the Government of Canada deliberately or otherwise imposed on them a gross unconstitutional unfairness by the so-called merging rather than stacking their Annuity contributions and benefits. The fact is that the Government of Canada has broken our enrolment contract without prior member consultation or authorization. During our enrolment contract we were promised that we would benefit of a full pension calculated at 2% of our best 6 years for a period of 25 years of service. This CPP claw back situation also affects Veterans drawing the CPP disability benefits. This Government action was taken without any Veterans consultation. Senior Officers have no authority to negotiate their benefits. Legal representation was not made available. Today the maximum contributions to both plans continue to be listed separately on our pay guide, given them a false sense of Financial Security. Furthermore, the vast majority of serving personnel were not informed of the CPP claw back plan until they arrived at age 65. Take notice that in 1966 the CPP contributions were 1.8% of basic rate of pay. Today’s contributions are 4.95% of basic rate of pay. The difference is an additional 3.15% is taken from our basic rate of pay. Why is it that we loose all of our CPP benefits on our Canadian Forces Superannuation?

CPP Facts:

The Government of Canada enacted the Canada Pension Plan (CPP) in 1965 and the plan came into force on January 1, 1966. Its intention was to provide another source for an “Income Security” program to supplement the Old Age Security Pension Plan. As of June 30, 2015, the CPP funds delivered a strong investment performance with an all time high surplus of $268.6 billions. We are aware that the CPP funds are going to grow by 2050 by something like 1 Trillion dollars. (CEO,CPPIB)

Veterans are aware that the Government of Canada has depleted over $16.5 billion dollars and a further $ 630 million dollars in 2003/04 to pay down the National debt. These surplus funds are considered to be a Sacred Trust Obligation to the Financial welfare of Canada’s Forces personnel and their Families during their retirement Golden years. During the 6 and 5 price and wage control years, the Government of Canada took a contributions holiday to our Service pension accounts and never paid it back.

The Canadian Forces annual Annuity report, ending 31 March 2013, indicated that there were 86,305 retired Military Annuitants in receipt of an Annuity. Only $2.673 billion was required to pay all annuities` under the Canadian Forces Superannuation Act for the year 2013.

Military/RCMP Veterans are not seeking any additional funds from the Public purse. They are seeking a fair and equitable treatment in receiving their unreduced CFSA/RCMP Annuity at age 65, or sooner if disabled.

Our Pension surpluses continue to grow. As of 31 March 2013, the net assets held on behalf of the Canadian Forces pension plan indicated that the Veterans Annuity plan total $62.108 billion dollars. It clearly indicate that Veterans are not receiving what they paid for.

The phrase “Bridge Benefits” is a misrepresentation of facts! It is not listed in the Pension Act and/or the Base Financial Counselor’s manual. (A-Fn-109-001/ID-001) Furthermore, the manual was not made available to service personnel. The bridge benefit term is a myth that was never used prior to the establishment of our Annuity Campaign.

Military/RCMP Service Consideration:

- Compare the following different issues Military/RCMP personnel face on a regular basis: What price tag can we place on the Voluntary service we ask our Spouse to perform while we serve our Country Canada?

- Loss of Veterans Financial disability protection in the application of the New Veterans Charter;

- Loss of Spouse income/employment opportunities as a result of member numerous operational moves, leading to the loss of Spouse CPP benefits;

- Spouses often face extended Family separation with elevated level of stress while maintaining a family on their own. The unavailability to celebrate Anniversaries, Birthdays and Family gathering;

- Numerous moves affecting the ability and opportunity to purchase a home and be mortgage free during a career;

- Veterans have served far abroad on numerous 24/7, 16 hour days without overtime compensation;

- Veterans faced dangerous conditions, health hazards and they were committed to an unlimited liability;

- The Supplementary Death Benefit (SDB) for Public service employees is set at $10,000 while Forces personnel is set at $5,000;

- Senators, Members of Parliament and Judges Advocate are exempted the CPP claw back to their pension at age 65; and

- Senators and MP’s Spouse survivors benefit is 66% of the members Annuity while Forces Spouse can only receive 50%.

Endorsement of the Campaign:

This worthwhile initiative continue to grow! Over 112,500 Military/RCMP Veterans have pronounced their support of the issue. To date 121 former Colonel and Generals have signed our Veterans petition. It included the signatures of 54 former officers of the rank of Generals and/or former RCMP Superintendents.

The Dominion Command of the Royal Canadian Legion, the Army, Navy and Air Forces Veterans (ANAVETS) of Canada and the Air Forces Association in Canada have adopted resolutions at their Annual General meetings in 2006 in full support of our campaign. Support has also been received from Mrs Lilian Morgenthau, Founder and President of CARP (Canada’s Association for the 50 plus). RCMP Deputy Commissioner Larry R. Proke, Mr. Bill Gildley, Executive Director, RCMP Veteran’s and Mr. Alex Geddes National Secretary, RCMP Veteran’s Association have unanimously supported our issue. Numerous other Military Associations have also declared their support.

On May 6, 2008 Mr. Jack Frost, Dominion Command President of the Royal Canadian Legion, sent a letter to the Minister of the National Defense with copies to The Prime Minister of Canada and The Minister of Veterans Affairs expressing his grave concerns regarding the issue of fairness pertaining to the CPP reduction to the CFSA.

In 2011, the Yukon and the Nova Scotia Provincial standing committees on Veterans Affairs unanimously passed motions in support of the Military/RCMP veterans Annuity issue.

Conclusion:

Prime Minister Harper did not honour his 2005 election campaign promise to respect the successful vote of Parliament Bills. His Government must acknowledge that the democratic successful vote of 149 yeas for Bill C-201 must be acted on. Since no additional funds are required from the taxpayers, A royal Recommendation should not be required.

This undemocratic CPP Annuity benefit reduction imposed upon Military/RCMP Veterans without fair and open consultation now affects the welfare of Veterans and their Families during their well earned Golden years of retirement. Surely, the Government has a solemn obligation to treat its Veterans with fairness and dignity. Sufficient funds are available in our Annuity account to resolve this outstanding issue.

We live in a free Country today because over 100,000 Canadians service members died on the field of battles since 1914. Some Veterans shed some blood, some did not return, all were prepared to give the ultimate sacrifice and some Families gave it their all. The sacred trust obligation to Veterans and their Families must be restored in their Golden Years. Military/RCMP Veterans and their Families have paid for it in so many different ways.

“ Kindness is a language the Deaf can hear & the Blind can see ! “

Sincerely,

John Labelle

Veterans Annuity Campaign

Coordinator

Honour, Dignity, Justice, Equality !

florencejohn@ns.sympatico.ca

902-864-2456

27 Dresden Court

Lower Sackville

Nova Scotia

B4C 3X1

Note: Send us your e-mail address to stay current with the issue. We maintain an e-mail address bloc list by provinces and use the BCC format. We do not charge membership fees.

Revised: August 21, 2017

“ In memory of Roger Boutin, Public Relation Coordinator ! “

Annex B – Discussion – Issue 2

Issue 2

Are the monthly pension amounts of former CAF and RCMP members reduced at age 65, due to receipt of a Canada Pension Plan Retirement Pension?

Assessment

The Canada Pension Plan (CPP) came into effect on January 1, 1966 and applied to all provinces and territories except Quebec, where the separate but similar Quebec Pension Plan was established in the same year. By agreement the two plans were coordinated so that workers could move freely between Quebec and other provinces/territories without penalty.

At that time, the Public Service Superannuation Act (PSSA), the Royal Canadian Mounted Police Superannuation Act (RCMPSA) and the Canadian Armed Forces Superannuation Act (CFSA) pension plans, were coordinated with the CPP. This means that rather than operate as two separate plans, individuals would pay predetermined amounts to the CPP and to their employer sponsored plan and the subsequent payments from the plans (pensions) would be combined to guarantee a certain level of income based on pre-retirement income and the number of years of contributions to the plans.

Prior to 1966, members of the CAF were paying 6% of their salary into the CFSA. In 1966, when the Canada Pension Plan (CPP) was integrated with the CFSA (as were all other public service pension plans), CAF members continued to pay 6% of their salary into pension benefits. The only change was that 1.8% now went to CPP[1] and 4.2% went to CFSA.

Prior to 1966, under the CFSA on retirement, the member would receive 2% of their best six-year average salary per year or partial year of service. For example, a former member with 32.5 years of service would be entitled to receive a pension equivalent to 65% of the average of their 6 years highest salaries. The 6-year average was reduced to five years in 1999.[2]

Members of the CAF typically retire well before age 65 given that the mandatory age of retirement is age 60 and extensions past age 60 are only possible under limited conditions.[3] Additionally, members of the Regular Force have retirement options after ten years of service and Reserve Force Members have retirement options after two years of service. There are three basic pension benefit options available to a CAF member under the CFSA:

When members collect their retirement pensions, it consists of two parts:

The larger part (approximately 70%) is the lifetime annuity and that amount will continue until the member dies. The smaller part (approximately 30%) is termed the “bridge benefit” and serves to “bridge” the pensioner’s income at the full amount until age 65, when most people start collecting CPP. Both parts are indexed.[7]

The “bridge benefit” did not exist prior to the introduction of the CPP in 1966. Rather the pension was simply a base annuity that was not reduced at a predetermined age.

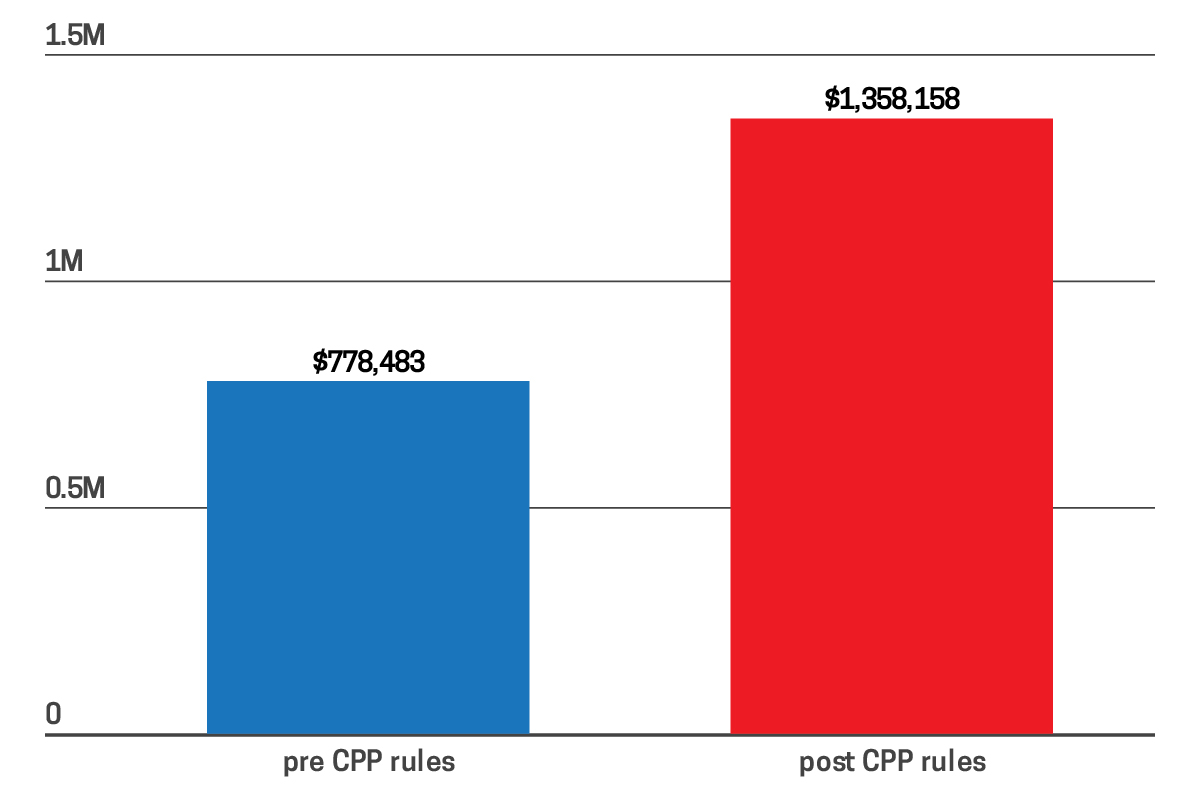

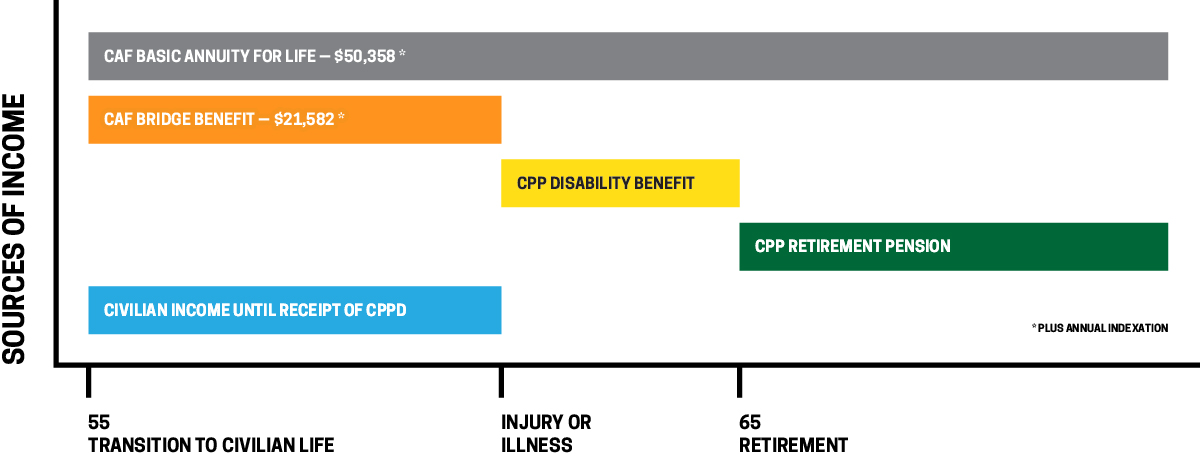

(See chart 1 and 2)

In most cases, the amount of CPP Retirement Pension that commences will be at least equal to the amount of the bridge benefit that ceases, thus giving the former member a consistent income flow throughout retirement years. This will not be the case under two circumstances:

1) If the member does not earn taxable income from CAF retirement age to age 65, he/she will not have contributed to CPP for that period. Therefore, the amount of CPP eligibility will be less and will likely be less than the bridge benefit, which ceases at age 65. In most cases, working or not is a decision the member makes.

2) Canadians can draw CPP as early as age 60, with a reduction of 0.6% per month before age 65. Total reduction at age 60 would, therefore, be 36%. That is the amount (plus indexing) that the pensioner will receive for the rest of his/her life. A former member taking CPP at age 60 will, in effect, be receiving both the bridge benefit and CPP for five years, but he/she must be prepared for a reduction in overall benefit when the bridge benefit ceases at age 65. At that point, the remaining integrated CFSA (lifetime benefit) and (reduced) CPP retirement pension will likely be less than the combination of lifetime benefit and “bridge benefit”. The total pension benefit continues to be indexed. The decision to take CPP early rests with the former member.

The decision to integrate with the CPP was in line with the approach taken for the majority of Canadian pension plans, including the plans provided under the Public Service Superannuation Act (PSSA), the CFSA and the RCMPSA.

If the design of the coordinated plans had been to pay both CPP Retirement Pension and an unreduced CFSA annuity for life (both the base amount and the bridge benefit), the cost to the contributor would have been greater. The 4.2 % contribution rate was based on the bridge benefit ending at age 65.

Our office has therefore concluded that former members of the Canadian Armed Forces and the Royal Canadian Mounted Police are in receipt of what they are entitled to according to the plan. Any proposal that would eliminate the bridge benefit to account for a CPP Retirement Pension would likely result in increasing the contribution rates of current members or funding the shortfall with other public money.

For more information regarding CFSA please refer to

and for additional information regarding the CPP, please refer to https://www.canada.ca/en/services/benefits/publicpensions/cpp.html

1 - CPP contribution info. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/canada-pension-plan-cpp/cpp-contribution-rates-maximums-exemptions.html

2 - As a result of changes to the Budget Implementation Act and changes to the Public Sector Pension Investment Board Act. https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/public-service-pension-plan-history.html

3 - Information on the exception provisions. http://www.forces.gc.ca/en/news/article.page?doc=new-compulsory-retirement-age-for-the-cf/hnocfnhk

4 - Members who do have a sufficient number of years of service to qualify for an annuity (pension), receive a full refund of the contributions that they have paid to the pension plan.

5 - An annuity (pension) that is determined when a former member’s, service ends, but which is not payable until some later date. This payment usually occurs at the member's normal or early retirement age.

6 - An annuity (pension) that is payable immediately upon the retirement of a member.

7 - The Canadian Forces Superannuation Act (CFSA) provides for annual increases, based on increases in the Consumer Price Index, on all pensions payable under the Act. Indexing for the year of retirement will be prorated to reflect the number of full months remaining in that year after the month in which the annuity commences

Annex B – Issue 2 Chart 1

Comparison of Pensions In 2018

This chart illustrates that former members continue to reap benefits years after the introduction of the CPP ,and the subsequent introduction of indexing to amounts payable under the CFSA. The value of a current monthly pension of $5488 is clearly substantially higher due to the introduction of CPP and the indexation of pensions.

An annual pension of $5488 ($457.35 per month) in 1966, is equivalent to an annual pension of $41,330 ($3738 per month) in 2018 dollars.9

The present value of this pension based on pre CPP rules would be $778,483 in 2018 dollars based on 25 years of benefits.10

The value of this same pension in post CPP rules including indexing, would be $1,358,158 in 2018 dollars based on 25 years of benefits.11

9 - Based on the historical inflation rates from 1966 to present https://www.bankofcanada.ca

10 - Based on current 10-year bench mark bonds (2.28%). https://www.bankofcanada.ca

11 - Based on current annual inflation rate of (2.99% ) and 10-year bench mark bonds (2.28%) https://www.bankofcanada.ca

Annex B – Issue 2 Chart 2

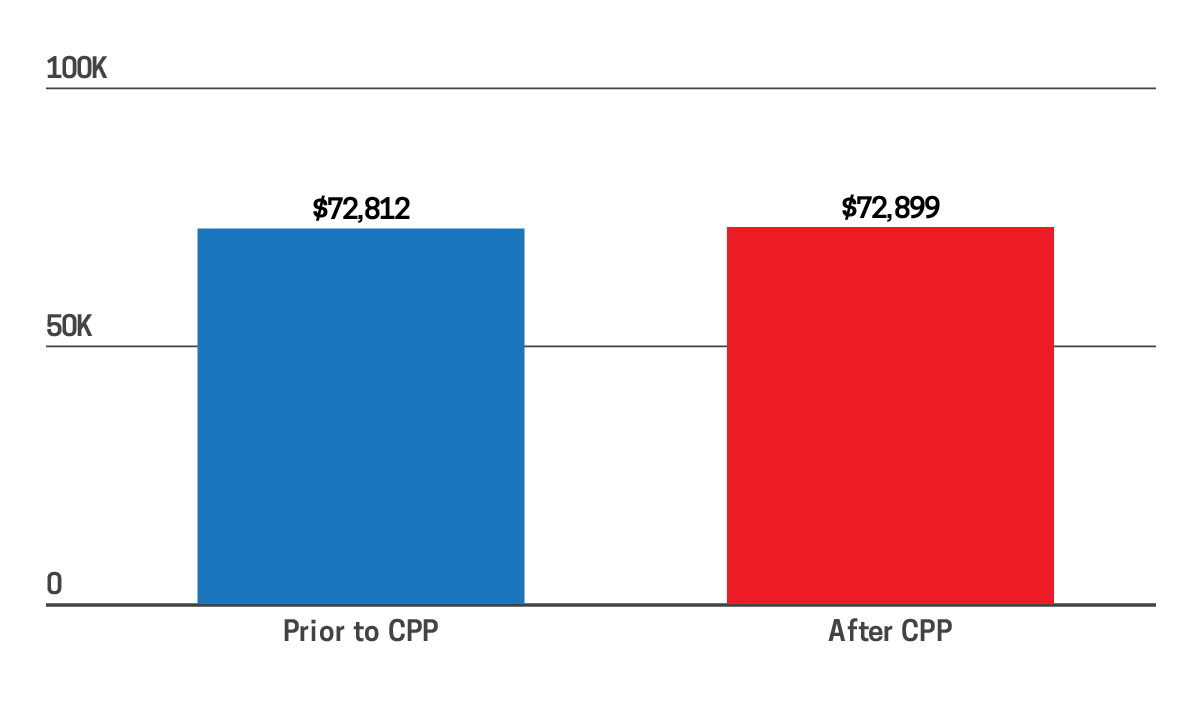

Comparison of CAF Pension Benefits

Prior to the introduction of CPP in 1966 To CAF Pension Benefits After the Introduction of CPP in 1966

This chart clearly demonstrates that former members have not suffered any financial loss as a result of the introduction of the CPP in 1966. The only difference for former members is that prior to the introduction of the CPP, they received their pension benefits solely from the CFSA, whereas after the introduction of CPP they received their benefits from two sources, CPP and the CFSA.

| Prior to CPP: | After CPP: |

|---|---|

|

Monthly salary of a corporal basic was $653.3517 Monthly pension based on 70% of 6 best years average $457.35 The value in of the pension in 1966 based on retirement at age 55 and an average lifespan of 25 years was:

|

Monthly salary of a corporal basic was $653.35 Monthly basic pension at (70 % of 457.35) $320.15 for life $50,970 based on 5 best years average Monthly bridge benefit at (30% of 457.35) $137.20 to age 65 $12,481 CPP Retirement Pension (30% of 457.35) commencing at age 65 for life $9,447 |

|

Total $72,811818 |

Total $72,89919 |

17 - The salary is based on the 2018 salary rate for a corporal basic, standard pay group, discounted by the average rate of inflation for the period as reported by the Bank of Canada. https://www.bankofcanada.ca

18 - Based on the long-term Canada bond rate as reported by Statistics Canada https://www150.statcan.gc.ca/n1/pub/11-210-x/2010000/t098-eng.htm

19 - Based on the long-term Canada bond rate as reported by Statistics Canada https://www150.statcan.gc.ca/n1/pub/11-210-x/2010000/t098-eng.htm

Annex B – Issue 3

Issue 3

Is it unfair that the pension plan for Senators and Members of Parliament and the pension plan for Federally Appointed Judges were not coordinated with the Canada Pension Plan in 1966 in the same manner as for members of the Canadian Armed Forces, the Royal Canadian Mounted Police, and the federal public service?

Assessment

The Members of Parliament Retiring Allowances Act, which encompasses both the members of the Senate and the House of Commons, was not amended in 1966 to coordinate contributions and benefits. Members of the Senate and the House of Commons continued to make full contributions to their pension plan and the CPP. The Members of Parliament Retiring Allowances Act was amended in 2015 to allow for the coordination of contributions and benefits with the CPP starting in January in 2016.[15]

The pension plan established for federally appointed Judges by the Judges Act[16] does not coordinate contributions and benefits with the CPP. Federally appointed judges make contributions to both their pension plan as required by the Judges Act and the CPP separately, and the benefits received from each plan at retirement are separate and independent of each other. Federally appointed judges, do not receive a reduction in their pension plan contributions to allow for CPP, as do members of the CAF, RCMP and federal public servants. They pay the full contributions to both the CPP and their pension plan, and as a result receive full benefits from both plans. In essence, they are in receipt of what they paid for.

Conclusion

The pension plan for Parliamentarians was coordinated with the CPP in 2015. The pension plan for federally appointed judges remains independent of the CPP, thus they contribute 7% of their salary[17] plus 4.95% of contributory earnings to CPP.[18]

While it is true that former federally-appointed judges and Members of Parliament had different pension plans at their disposal since 1966, it is difficult to use this as a legal basis to argue the creation of the new benefit. It is also worth mentioning that changes were made to the “Members of Parliament Retiring Allowances Act” (MPRAA) in 2015,[19] to bring the pension plan for Members of the House of Commons and the Senate in line with the pension plans for members of the Canadian Armed Forces, members of the RCMP and the federal public servants.

[15] - Information on Parliamentary Pensions https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/pension-publications/reports/administration-members-parliament-retiring-allowances-act-report/fiscal-year-ended-march-31-2015.html

[16] - Information concerning the pension plan for federally appointed Judges. http://laws-lois.justice.gc.ca/eng/acts/J-1/

[17] - Actuarial Report,2016 http://www.osfi-bsif.gc.ca/Eng/Docs/faj-jnf16.pdf

[18] - CPP contribution information. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/payroll-deductions-contributions/canada-pension-plan-cpp/cpp-contribution-rates-maximums-exemptions.html

[19] - Information on Parliamentary Pensions https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/pension-publications/reports/administration-members-parliament-retiring-allowances-act-report/fiscal-year-ended-march-31-2015.html

Annex B – Issue 4

Issue 4

Are members who contributed to the Canadian Forces Superannuation Act pension required to pay an additional 1% administration fee in addition to their CPP and CFSA contributions?

Assessment

There is no reference to a one 1% administration fee in the Canadian Forces

Superannuation Act pension, however the issue of indexation may have created the perception of an administration fee.

In 1966, members of the CAF were contributing 6% of their salary to the CFSA. When CPP was coordinated with the CFSA, CAF members continued to contribute 6% of their salary for pension benefits. The only change was that 1.8% now went to CPP and 4.2% went to CFSA.

However, in 1970, the Government introduced indexing through the Supplementary Retirement Benefits Act. The new Act provided for increases in the pensions of retired members and their surviving dependents. Benefits payable under the Act were automatically and annually indexed to protect against cost-of-living increases.[19]

These increases were subject to a 2% ceiling under the legislated indexing formula, and employees were required to contribute an additional 0.5% of their salary.

Subsequently, in 1974, the 2% ceiling on annual pension indexing increases was removed for the Public Sector, RCMP and CAF pension plans and a provision was made for a further 0.5% employee contribution increase, effective January 1, 1977.

It is true that members of the Canadian Armed Forces like federal public servants and members of the RCMP, pay an additional 1% contribution to their pension plan. However, this additional contribution is to provide protection against inflation (indexed pensions).

The indexing provides for annual increases to former members pensions based on increases in the Consumer Price Index.

Conclusion

No further action required.

[19] - History of Government Pension Plans https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/public-service-pension-plan-history.html

Annex B – Issue 4 Chart 3

Effect on Pensions Indexation

The following chart clearly illustrates the the value of an indexed pension versus a non-indexed pension. While former members pay a premium for indexation, the financial benefits exceed the amount of that premium.

| Note 1: | Note 2: |

|---|---|

|

Members paid 1% of salary for inflation protection which provided for 4% average annual increase in their pensions. this means that:

|

Annex B – Issue 5

Issue 5

Will a retroactive payment from the CPP Disability Benefit generally create an overpayment that must be repaid, in the SISIP Long-Term Disability Plan and/or the Veterans Affairs Canada Earnings Loss Benefit and/or the Canadian Forces Income Support Benefit?

Assessment

Former members are required to apply for the CPP Disability Benefit in order to continue to receive benefits from SISIP and various VAC programs. Any amounts received from the CPP Disability Benefit require a corresponding reduction in the benefits from SISIP and some VAC Programs.

Often, due to delays in processing, the CPP Disability Benefit will have a retroactive component, which then creates an overpayment in SISIP or a VAC program creating some cash flow and income tax challenges for the former members as the payments from these sources are considered taxable.

Conclusion

There are times when a retroactive CPP Disability Benefit payment may create an overpayment in some SISIP and VAC programs.

Annex B – Issue 6

Issue 6

Can members of the Canadian Armed Forces access Employment Insurance Benefits?

Assessment

A review of the website for Employment and Social Development Canada states that Canadian Armed Forces members (regular or reservist), can receive the same benefits as other Canadians under the Employment Insurance Act as long as they meet the same eligibility as other Canadians. This includes regular benefits, as well as maternity, parental, sickness, compassionate care and family caregiver benefits.[20]

Conclusion

Employment Insurance benefits are available to members of the Canadian Armed Forces.

[20] Information regarding benefits for members of the CAF and their families. https://www.canada.ca/en/services/benefits/ei/ei-military-families.html

Annex C – Bibliography

Canadian Federal Acts

Canada Pension Plan.

https://laws-lois.justice.gc.ca/eng/acts/C-8/

Canadian Forces Superannuation Act.

https://laws-lois.justice.gc.ca/eng/acts/C-17/

Income Tax Act.

https://laws-lois.justice.gc.ca/eng/acts/I-3.3/index.html

Judges Act.

https://laws-lois.justice.gc.ca/eng/acts/J-1/

Members of Parliament Retiring Allowances Act.

https://laws-lois.justice.gc.ca/eng/acts/M-5/FullText.html

Old Age Security Act.

https://laws-lois.justice.gc.ca/eng/acts/O-9/

Public Service Superannuation Act.

https://laws-lois.justice.gc.ca/eng/acts/P-36/FullText.html

Royal Canadian Mounted Police Superannuation Act.

https://laws-lois.justice.gc.ca/eng/acts/R-11/FullText.html

Provincial Public Pension Plans

Public Service Pension Plan (British Columbia):

https://pspp.pensionsbc.ca/?pcShortUrl=pspp.pensionsbc.ca

Public Service Pension Plan (Alberta):

https://www.pspp.ca/page/pspp-home#

Public Employees Pension Plan (Saskatchewan):

http://www.peba.gov.sk.ca/pensions/pepp/home.html

Civil Service Superannuation Plan (Manitoba):

http://www.cssb.mb.ca/

Public Service Pension Plan (Ontario):

https://www.opb.ca/portal/opb.portal?_nfpb=true&_pageLabel=WelcomePage

Public Sector Pension Plans (Quebec):

https://www.carra.gouv.qc.ca/ang/publications/publi_participants.htm

New Brunswick Public Service Pension Plan:

https://www2.gnb.ca/content/gnb/en/departments/treasury_board/human_resources/content/pensions_and_benefits/pp/pssa.html

Civil Service Superannuation Plan (Prince Edward Island):

http://www.peicssf.ca/index.php3?lang=E

Public Service Superannuation Plan (Nova Scotia):

https://www.nspssp.ca/

Public Service Pension Plan (Newfoundland and Labrador):

https://www.fin.gov.nl.ca/fin/pensions/plans_PSPP.html

Web Sites

Canadian Armed Forces Pensions:

http://www.tpsgc-pwgsc.gc.ca/fac-caf/accueil-home-eng.html

Canadian Museum of History:

www.historymuseum.ca

Department of National Defence:

www.forces.gc.ca

Employment and Social Development Canada:

www.canada.ca/en/services/benefits/publicpensions/cpp/contributions.html

Encyclopedia of Military Ethics:

www.militaryethics.org/

Government of Canada:

www.canada.ca

Library of Parliament:

https://lop.parl.ca/sites/PublicWebsite/default/en_CA/

Open Parliament:

https://openparliament.ca/

Royal Canadian Legion:

www.legion.ca

Service Income Security Insurance Plan (SISIP):

www.sisip.com/en/

Veterans Affairs Canada:

www.veterans.gc.ca

Articles and Reports

Arthurs, Harry W. “Collective Bargaining in the Public Service of Canada: Bold Experiment or Act of Folly?” Michigan Law Review 67.5 (1969): 971-1000. https://digitalcommons.osgoode.yorku.ca/cgi/viewcontent.cgi?referer=http://www.google.ca/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&ved=2ahUKEwiJs_7w3a7eAhVNvFkKHVslDNEQFjABegQIABAC&url=http%3A%2F%2Fdigitalcommons.osgoode.yorku.ca%2Fcgi%2Fviewcontent.cgi%3Farticle%3D1771%26context%3Dscholarly_works&usg=AOvVaw1k3nxcafRMY6bIoWyDngZX&httpsredir=1&article=1771&context=scholarly_works

Cruz, Marvin. “The Bridge Benefit: Hidden secret to retiring early in the public sector” Canadian Federation of Independent Business Research Snapshot (March 2016) https://www.cfib-fcei.ca/sites/default/files/article/documents/rr3389_0.pdf

Government of Canada. National Defence. 2011-12 Annual Report Your Plans…Your Future. https://afpaac.ca/PDFs/News/CFSA%20Annual%20Report%202011-12.pdf

Treasury Board Secretariat. Public Service Pension Plan History. https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/plan-information/public-service-pension-plan-history.html

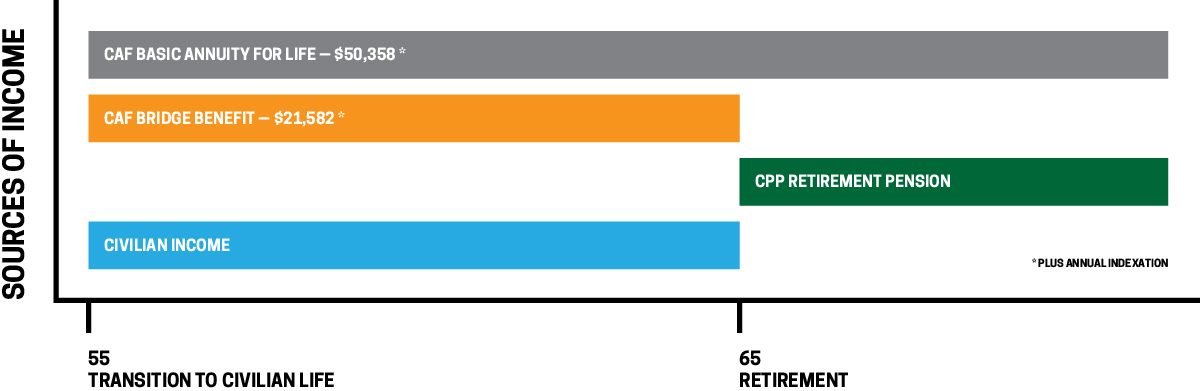

Scenario 1A

Sam retires from the Canadian Armed forces (CAF) in 2018 at age 55 earning a Sergeants salary of $71,9401.

Sam continues to work outside of the CAF until age 65.

At age 60, Sam can apply for CPP Retirement Pension at a revised amount or wait until age 65 to receive the full amount of CPP Retirement Pension.

At age 65, Sam will cease to receive the CAF Bridge Benefit given Sam’s eligibility for CPP Retirement Pension.

1 Salary based on Sergeant, Level 6 A, Standard, Pay increment 4. per National Defence Website

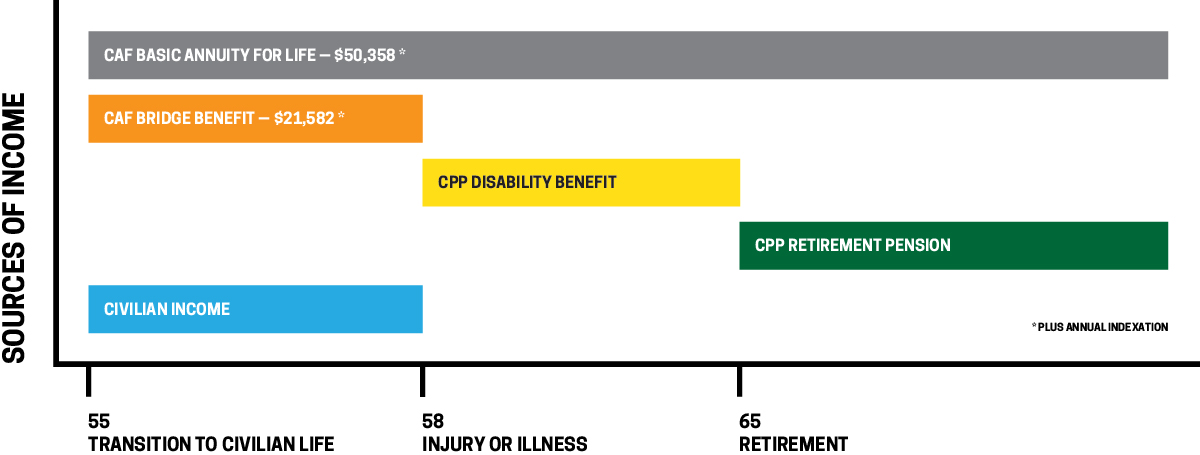

Scenario 1B

Sam retires from the Canadian Armed Forces (CAF) in 2018 at age 55 earning a Sergeant’s salary of $71,9401.

Sam works as a civilian until age 58, when Sam becomes unemployable due to an accident.

Sam now receives the CPP Disability Benefit. However, Sam is no longer eligible to receive the CAF Bridge Benefit.

At age 60, Sam can apply for CPP Retirement Pension at a revised amount or wait until age 65 to receive the full amount of CPP Retirement Pension.

1 Salary based on Sergeant, Level 6 A, Standard, Pay increment 4. per National Defence Website

Scenario 2

Sam retires from the Canadian Armed Forces (CAF) in 2018 at age 55 earning a Sergeants salary of $71,9401.

At retirement, Sam receives a monthly CAF annuity indexed for life. Sam will also get a monthly CAF Bridge Benefit from retirement until age 65. At this age Sam will start receiving the CPP Retirement Pension.

Sam continues to work after retiring from the CAF. If Sam subsequently becomes ill or injured and unable to work, they will qualify for the CPP Disability Benefit.

In addition to losing the capacity to work, Sam will also lose the CAF Bridge Benefit that Sam had expected to receive until age 65. This is not a dollar for dollar offset with the CPP Disability Benefit, but a total elimination of the of the CAF Bridge Benefit, irregardless of the amount of the CPP Disability Benefit.

Disability drop-in:

When calculating the base component of CPP Retirement Pensions, periods during which individuals are disabled per the CPP legislation are not included in their contributory period. This ensures that individuals who are not able to pursue any substantially gainful work are not penalized.

When calculating the components of a retirement pension, individuals who are in receipt of a CPP Disability Benefit will have a credit dropped-in to the calculation for the months they are disabled. The value of the credit is based on the individual’s earnings during the six years before becoming disabled. If a disabled person does not apply for and receive CPP Disability, earnings for those years will be calculated at zero. his reduces the person’s average annual earnings for the Retirement Pension calculation.

1 Salary based on Sergeant, Level 6 A, Standard, Pay increment 4. per National Defence Website

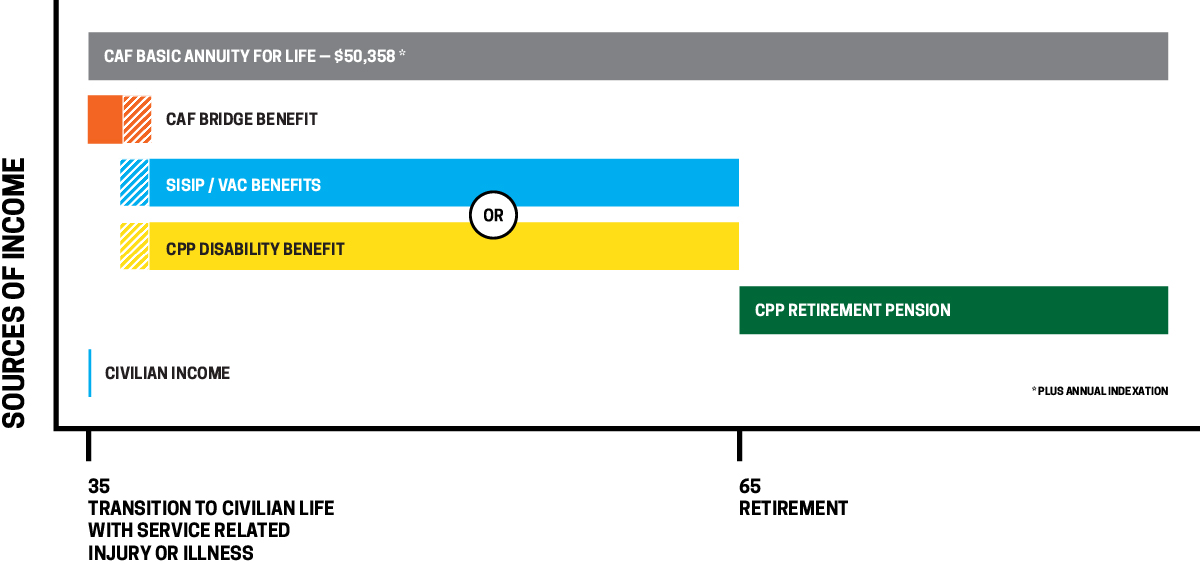

Scenario 3

Sam is medically released from the CAF at age 35 earning a Sergeant’s salary of $71, 9401.

Sam will receive an indexed CAF annuity for life. The CAF Bridge Benefit will be received until the earlier of receipt of a CPP Disability Benefit or the CPP Retirement Pension, usually at age 65.

As a result of a service-related illness or injury, subject to eligibility requirements, Sam initially receives benefits from the Service Income Security Insurance Plan (SISIP) and/or the VAC Income Replacement Benefit.

Sam is required to apply for the CPP Disability benefit in order to maximize the CPP Retirement Pension benefit calculation. Sam can choose to start receiving the pension between the ages of 60 and 70.

Any income received from the CPP Disability Benefit reduces the SISIP Income Replacement Benefits or the VAC Income Replacement Benefits.

Upon receipt of the CPP Disability Benefit, Sam is no longer eligible to receive the CAF Bridge Benefit.

While awaiting a decision on the CPP Disability Benefit application, Sam continues to receive SISIP or VAC benefits as applicable. Due to the delays in CPP decision making process, applications are approved retroactively, thus creating a repayable overpayment in the SISP and/or VAC benefits.

For further information regarding potential benefits, please refer to www.ombudsman.forces.gc.ca

1 Salary based on Sergeant, Level 6 A, Standard, Pay increment 4. per National Defence Website

Overview of Benefits Chart

| INCOME SUPPORT | TAXABLE YES / NO | REDUCED BY | WHEN |

|---|---|---|---|

| Old Age Security | YES | - | - |

| Canada Pension/Retirement Pension | YES | - | - |

|

Canadian Forces Superannuation (Annuity) |

YES | - | - |

|

Canadian Forces Superannuation (Bridge Benefit) |

YES | CPP-D | Age 65 or CPP-D APP |

|

Reserve Force Superannuation (Annuity) |

YES | - | - |

|

Resrve Force Supperannuation (Bridge Benefit) |

YES | CPP-D | CPP-D APP |

| Canada Pension/Disability Benefits | YES | - | - |

|

Service Income Service Insurance Plan (SISIP) |

YES | CPP-D | CPP-D APP |

|

Government Employees Compensation Act |

NO | CPP-D | CPP-D APP |

| Canadian Forces Income Support | YES | CPP-D | CPP-D APP |

| Disability Benefits | NO | - | - |

| Exceptional Incapacity Allowance | NO | - | - |

|

Health Care Benefits (Treatment Benefits) |

NO | - | - |

| Veterans Independence Program | NO | - | - |

| Critical Injury Benefit | NO | - | - |

| War Veteran Allowance | NO | - | - |

| The Caregiver Recognition Benefit | NO | - | - |

| The Education And Training Benefit | NO | - | - |

| Pension For Life: | |||

|

- Pain And Suffering Compensation (PSC) |

NO | - | - |

|

- Addictional Pain And Suffering Compensation (APSC) |

NO | - | - |

| - Income Replacement Benefit (IRB) | YES | CPP-D | CPP-D APP |

- Date modified: